Seattle Times On The Impact Of Amazon In Downtown Seattle

It’s been a huge year for Amazon.com and for downtown Seattle, according to The Seattle Times in a front page story today. The company not only closed on land purchased to construct three new office towers valued at $207 million covered here: (Amazon pays $207.5M for Denny Triangle site) but it also closed on the massive $1.3 billion acquisition of its headquarters, which it was leasing from Vulcan covered here: (Amazon’s billion-dollar South Lake Union deal closes).

The online retailer’s growth, and its impact on the future of downtown Seattle real estate fundamentals is just a harbinger of what’s to come says Dean Jones, President and CEO of Realogics Sotheby’s International Realty who contributed to the article.

It’s been a huge year for Amazon.com and for downtown Seattle, according to The Seattle Times in a front page story today. The company not only closed on land purchased to construct three new office towers valued at $207 million covered here: (Amazon pays $207.5M for Denny Triangle site) but it also closed on the massive $1.3 billion acquisition of its headquarters, which it was leasing from Vulcan covered here: (Amazon’s billion-dollar South Lake Union deal closes).

The online retailer’s growth, and its impact on the future of downtown Seattle real estate fundamentals is just a harbinger of what’s to come says Dean Jones, President and CEO of Realogics Sotheby’s International Realty who contributed to the article.

Pictured above: Amazon’s downtown Seattle campus in South Lake Union (photo by Seattle Times)

“If Amazon occupies 8 million square feet of office space in downtown Seattle by the end of the decade, then the online retailer could become as impactful to downtown housing as Microsoft’s campus was to Redmond and the surrounding marketplace,” says Jones. “We’ve certainly seen an increase in Amazon employees buying condos downtown but that’s just the tip of the iceberg. By giving this emerging demographic a few years, we’ll find that a good percentage of them will opt to own.”

The article acknowledged that Amazon workers seem more inclined to rent for now rather than buy but they have still given a boost to the downtown condo market. “The company’s growth has had a profound effect on the consumer psyche,” Jones said in the article. “It bolstered confidence to invest in downtown Seattle.”

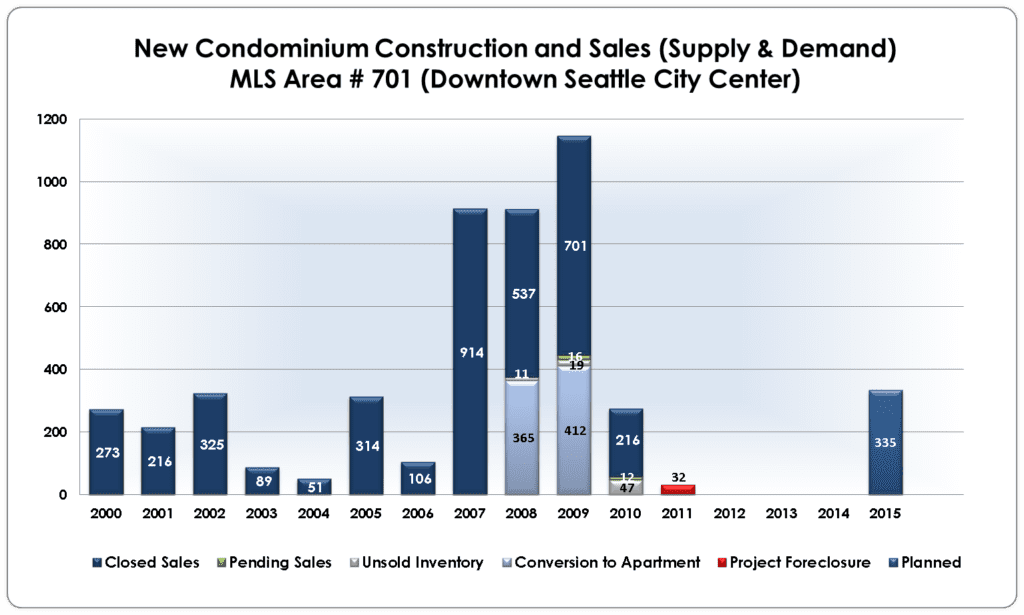

Such rise in demand comes at a time of historically low inventory. Research by Realogics Sotheby’s International Realty illustrates that the new construction pipeline has been pinched since the global credit crisis in 2008. Jones says there are fewer than 150 condos available to purchase today, which are evenly represented by new and resale properties. While at least one new condominium project is under construction and still others are planned, it could be several more years before this inventory arrives to the marketplace.

“These pressures (on supply and demand) will continue to increase median home prices in downtown Seattle while further limiting selection,” says Jones. “It’s not all about Amazon. A quickly recovering in-city housing market has encouraged many other buyer profiles to step off the sidelines. We’re seeing a dramatic rise in move-down buyers at the upper end finally able to sell their single family homes, move up buyers finally able to sell their smaller condos and even discretional buyer profiles like investors and second home buyers.”

Pictured above: The pipeline of condominiums in downtown Seattle will experience a dearth of new supply between years 2011 and 2015 – RSIR estimates only 78 new units remain available to purchase.

The market pundits agree that this young, affluent consumer profile prefers to live, work and play in the city. So while most new Amazon recruits may prefer to rent for a lease term or two, their rising rents and the inability to deduct lease payments from their personal tax return will eventually increase their propensity to own, and especially if mortgage rates remain historically low. The question remains, what will median home prices look like for them in a few years given the trajectory of the S&P/Case-Shiller Index in the region (link: Local home prices dip, though up 5.7 percent over 12 months) ?

“Higher – especially in downtown Seattle,” said Jones.

For more information about Events and things to do on Bainbridge Island, our Real Estate Market, Bainbridge Island Lifestyle, Condominiums, Luxury Waterfront Homes, Equestrian Properties, and Estates and Farms, visit www.homesforsaleonbainbridgeisland.com. Discover what “Loving Island Life” is all about!